30+ Loan to value ratio calculator

For example if youre buying an. If the value of the property was 500000 this would result in a loan to value ratio of 90 450000 500000 whereas if the house price was 300000 the LTV ratio would be.

Lvr Calculator And What Is Loan To Value Ratio Calculate Lvr

Enter your estimated home.

. This means the loan amount 250000 8. A Loan-to-Value ratio for a property is equal to all mortgages on a property divided by the appraisal value of the property. Ad Receive A Debt Consolidation Loan From JG Wentworth - 3 Decades Of Expertise A Rating.

If you want to customize the colors size and more to better fit your site then pricing starts at just. You can use this Loan to Value Calculator to calculate the loan-to-value LTV and cumulative loan-to-value CLTV ratios for your property. Skip the Bank Save.

The loan-to-value ratio commonly referred to as LTV is a comparison of your cars value to how much you owe on the loan. If you own a home worth 1000000 and get a new first. Find Out If You Qualify For a Low Rate in Minutes.

To see how the loan-to-value LTV formula works heres the basic formula and an example. Lock In Your Low Rate Today. Fixed loans 15-year fixed loans 30-year fixed loans ARM loans 5-year ARM.

Apply Easily and Get Fast Pre Approval. You currently have a loan balance of 140000 you can find your loan balance on your monthly loan statement or. So if youre buying a 300000 property and have a 60000 deposit.

Loan to Value LTV Calculator. The LVR formula is calculated by dividing the loan by the propertys value. JG Wentworth is Here to Help with Your Debt Consolidation Loan.

Ad Discover why PitchBook is the only tool you need for your next private company valuation. Get Offers From Top 7 Online Lenders. Loan to value is the ratio of the amount of the mortgage lien divided by the appraisal value of a property.

Ad Calculate and See How Much You Can Afford. The loan to value ratio calculator exactly as you see it above is 100 free for you to use. Our Loan-to-Value LTV Ratio Calculator helps you estimate how much you owe on your mortgage compared to your homes current market value.

At 4 appreciation the 1m home would be. Unbeatable Mortgage Rates for 2022. You can easily work out your LTV by dividing your mortgage amount by the value of your property then multiplying it by 100.

For example if youre buying a 100000 property with a 10000 10 deposit youll need a 90. Typically a loan-to-value ratio should be 80 or less to avoid having to add PMI. Loan-to-value LTV is the ratio of mortgage to property value expressed as a percentage.

In this case thats 480000600000 which makes the loan to value ratio 80. The loan-to-value LTV ratio helps lenders determine if your mortgage is sufficient collateral to secure the Note. The cost to build a property is 10 million and it will have a projected stabilized value of 12 million once complete.

Ad Need a Business Loan. Ad Best VA Home Loans Compared Reviewed. Get a Quote Today.

Compare Offers Apply. An LTV over 100 means you owe more on the loan than your. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

Imagine a lender has constrained you to the lesser of 75 LTC or 60. Check Your Eligibility See If You Qualify for a 0 Down VA Loan. Mortgage Loan 320000.

Loan-To-Value Ratio - LTV Ratio. Get more accurate data for financial models build and analyze comps quickly. Use Our Comparison Site Find Out Which Lender Suits You Best.

Calculate Your Rate in 2 Mins Online. The Loan-to-Value Ratio is a home equity figure that lenders use to assess risk. Current combined loan balance Current appraised value CLTV.

Check Your Eligibility See If You Qualify for a 0 Down VA Loan. The remaining 20 must be paid out of your pocket. Get a Quote Today.

Down Payment 80000. The loan to value LTV ratio is 80 where the bank is providing a mortgage loan of. Trusted VA Loan Lender of 300000 Veterans Nationwide.

Trusted VA Loan Lender of 300000 Veterans Nationwide. Or this value can be calculated by multiplying the propertys appraised value by 20 20 to get the total figure on a house deposit meaning. Get Pre-Qualified in Seconds.

The loan-to-value ratio LTV ratio is a lending risk assessment ratio that financial institutions and others lenders examine before approving a. The LTC calculator provided insight into how a higher LTV percentage means that the borrower owns. Ad Best Home Loan Mortgage Rates.

Lvr Calculator And What Is Loan To Value Ratio Calculate Lvr

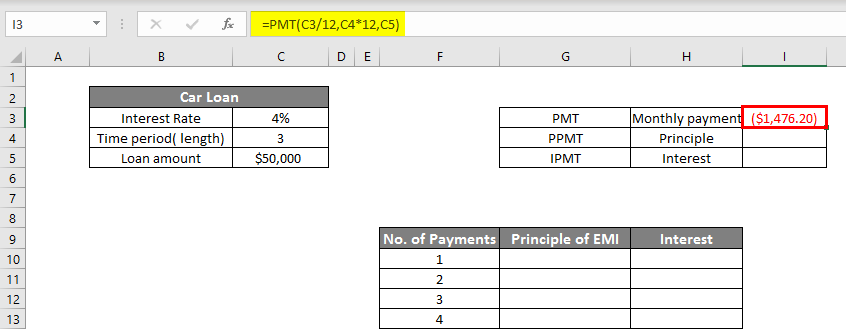

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

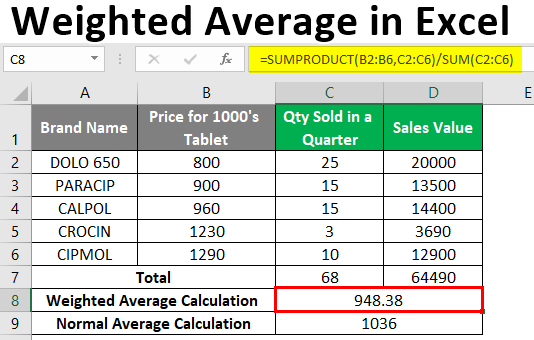

Weighted Average In Excel How To Calculate Weighted Average In Excel

Tan 30 Degrees Value Unit Circle Tangent Value

Business Valuation Calculator For A Startup Plan Projections Business Valuation Business Proposal Examples Financial Budget

Lvr Calculator And What Is Loan To Value Ratio Calculate Lvr

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Lvr Calculator And What Is Loan To Value Ratio Calculate Lvr

Is It Possible To Solve A Present Value Or Future Value Problem Where Both The Present And The Future Value Amounts Are Unknown And You Re Only Given The Interest Rate Per Period

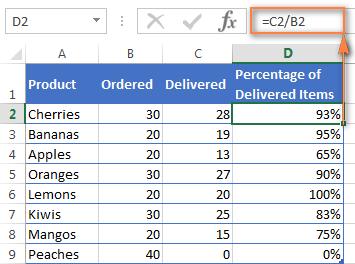

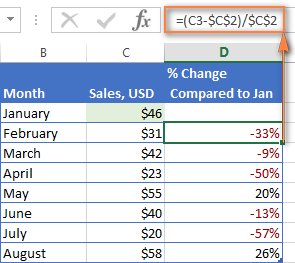

How To Calculate Percentage In Excel Percent Formula Examples

How To Calculate Percentage In Excel Percent Formula Examples

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

How To Calculate Percentage In Excel Percent Formula Examples

What Is The Future Value Of An Annuity Of 10 000 Payable Quarterly For 3 Years If Money Is Worth 12 Quora

Calculate Compound Interest In Excel How To Calculate

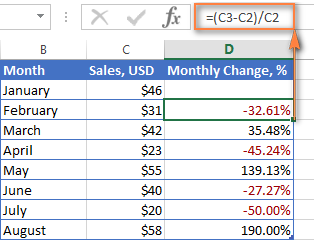

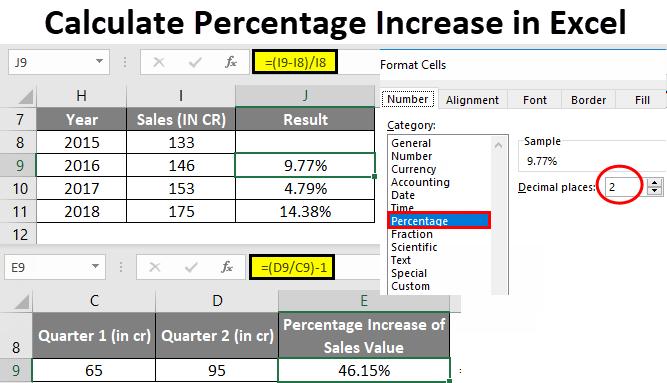

Calculate Percentage Increase In Excel Examples How To Calculate